Retail & Business Banking

Customer Service, Fraud Operations, Risk & Compliance

Customer Fraud Claims, Compliance & Documentation Automation

Check fraud remains a major operational burden for banks: 63% of organizations report being impacted by check fraud, and physical checks are the most targeted payment method1.

When customers identify fraudulent check activity, they must initiate a fraud claim process which requires banks to collect and validate:

These submissions are unstructured, vary by case, and often include handwritten and scanned content. Strict reporting rules apply making accuracy and processing speed critical to avoid financial loss and denied claims.

Historically, analysts manually reviewed each file, validated signatures and notarization, compared claimant identity to account records, checked submission completeness, and keyed data into internal case systems.

This resulted in:

1 AFP 2025 Study: Payments Fraud and Controls Survey Study

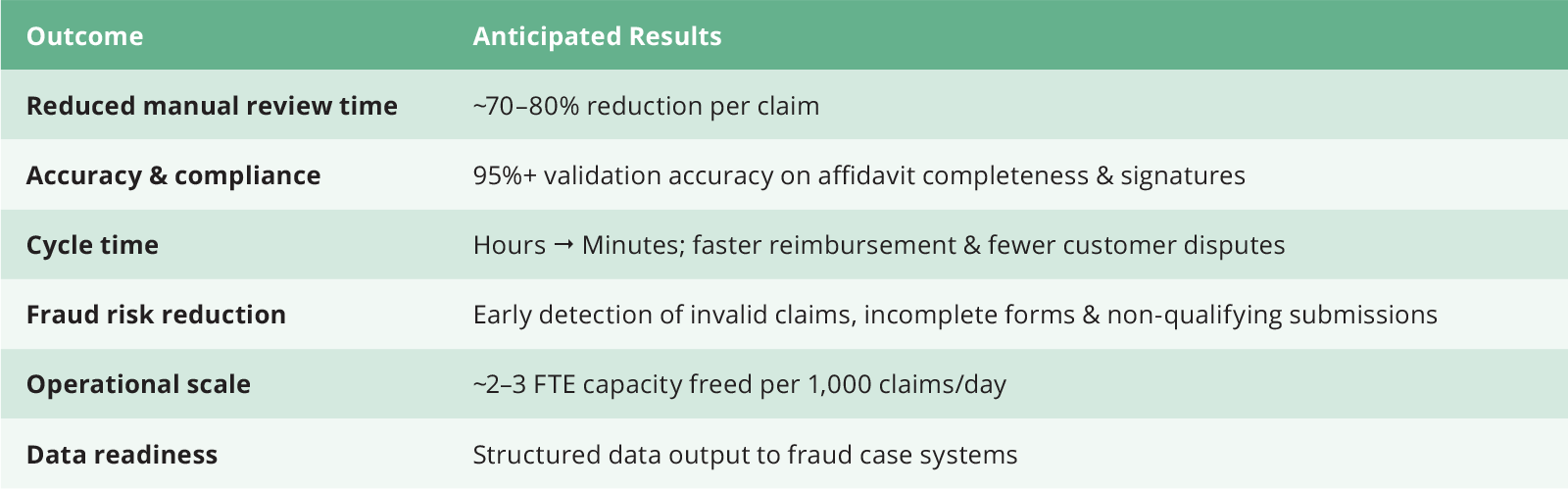

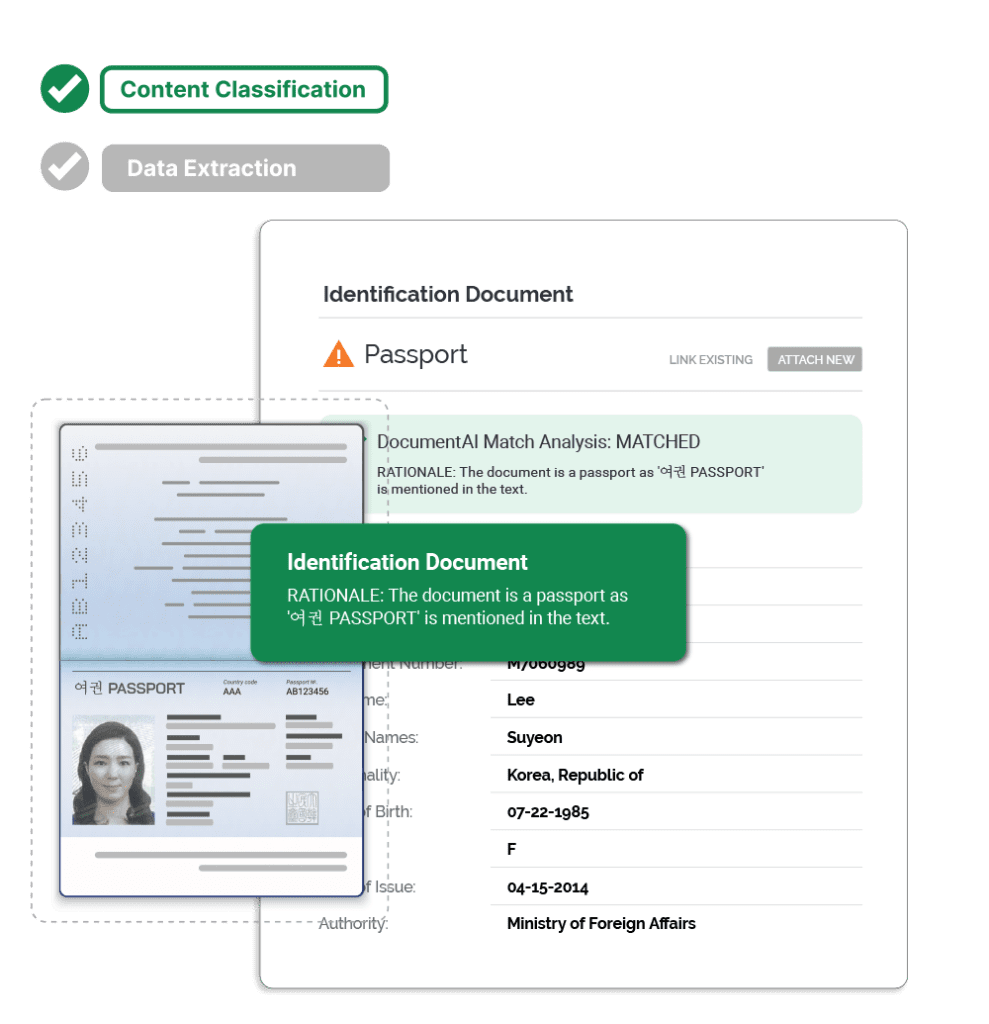

BizAI enables the end-to-end automation of the affidavit-based check fraud intake and review process, including:

emails, PDFs, scanned forms, photos, check images

correct form, required fields, dates, IDs

confirm notary elements, match customer identity

dates, amounts, check numbers, account IDs, claimant details

forged endorsement, altered check, counterfeit, mobile deposit, etc.

flag if reported within required window

for fraud case investigators & core systems

in enterprise workflow tool