Business Banking

Business/Corporate Account Onboarding / KYC / New Account Opening

Mid-to-large banks onboarding thousands monthly via branch, digital, and RM channels.

Business account onboarding is significantly more complex than consumer onboarding due to entity structure, regulatory obligations, and multi-party authorization. Financial institutions must verify:

Business account onboarding is significantly more complex than consumer onboarding due to entity structure, regulatory obligations, and multi-party authorization. Financial institutions must verify:

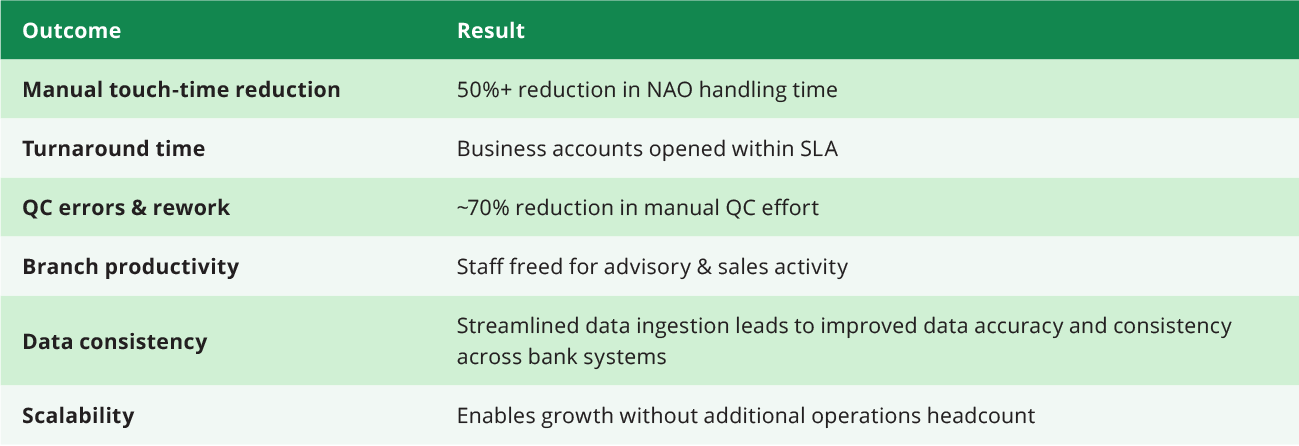

BizAI enables the full automation of the end-to-end new business account onboarding: