Wealth Management / Financial Advisory

Advisor Experience, Compliance

Client Onboarding, External Statement Ingestion, Portfolio Profiling & Replication

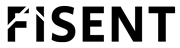

When onboarding a new client, advisors must manually review external brokerage statements, map the current holdings to available products/assets, and then re-enter all of the client’s holdings into internal systems. These statements vary significantly across custodians and require capturing numerous fields such as account information, symbols, quantities, CUSIPs, cash balances, buy/sell dates, and statement dates.

This manual process is slow, error-prone, and delays the ability to run financial projections or re-purchase client assets in the new platform.

Fisent BizAI automates ingestion and extraction of data from unstructured external brokerage statements using advanced document-understanding models. BizAI identifies and captures all required onboarding fields—including:

Extracted data is normalized into a structured template and passed to downstream trading and proposal systems with human-in-the-loop verification.

Faster onboarding: Reduces statement processing from hours to minutes

Higher data quality: Minimizes manual entry errors

Advisor efficiency: Frees advisors and their teams to focus on value creation, such as portfolio planning and client engagement

Operational scalability: Supports hundreds of statement formats and enables Straight Through Processing if desired

Compliance confidence: Ensures all required fields are consistently captured and creates an auditable trail for downstream reviews and approvals