Residential Mortgage Lending

Mid-sized, privately held mortgage lender

Loan Origination — Loan Estimate (LE) Preparation

Purchase Contracts are long, unstructured agreements that define the core economics of a home purchase—property details, parties, contingencies, personal property, fees, and who pays what. Lenders must rapidly interpret and validate this information to produce an accurate Loan Estimate (LE) within three business days of application based on TRID tolerances.

When contract terms or fees are missed or underestimated, lenders typically absorb the difference as tolerance cures and other overages at closing—costs that add up quickly. Accurate, timely interpretation of Purchase Contracts isn’t just an operational imperative —it’s a significant P&L risk.

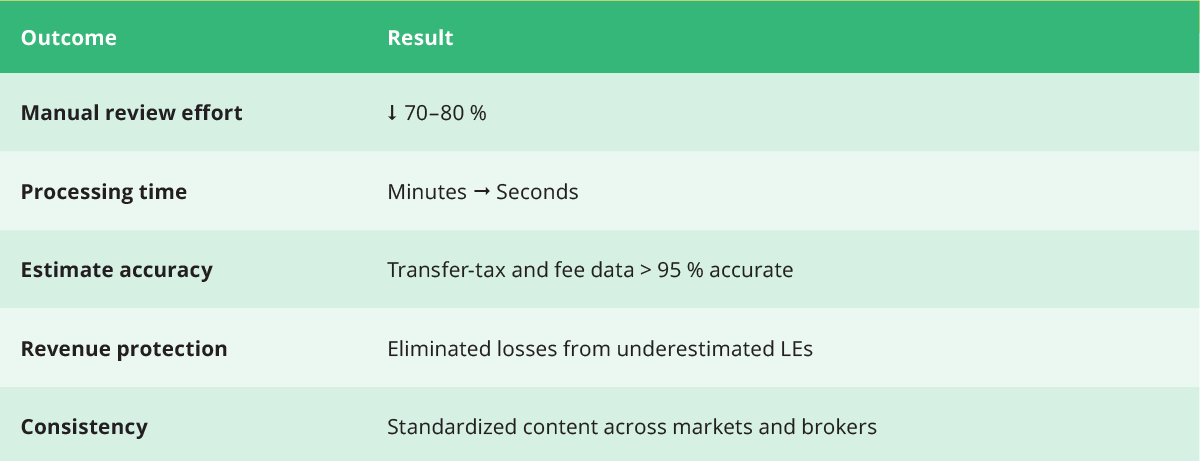

The result:

Lenders need a way to automate the ingestion and normalization of purchase agreement data to build accurate, compliant Loan Estimates at scale.

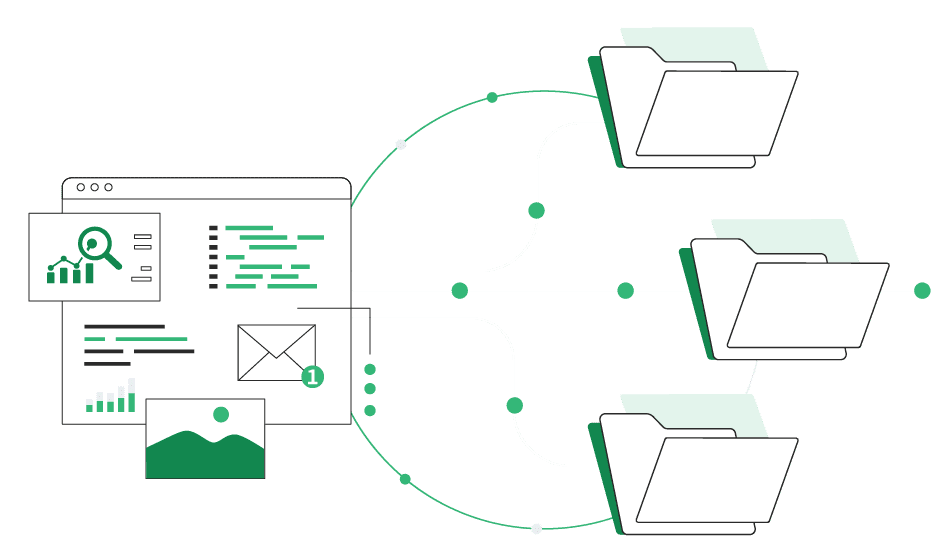

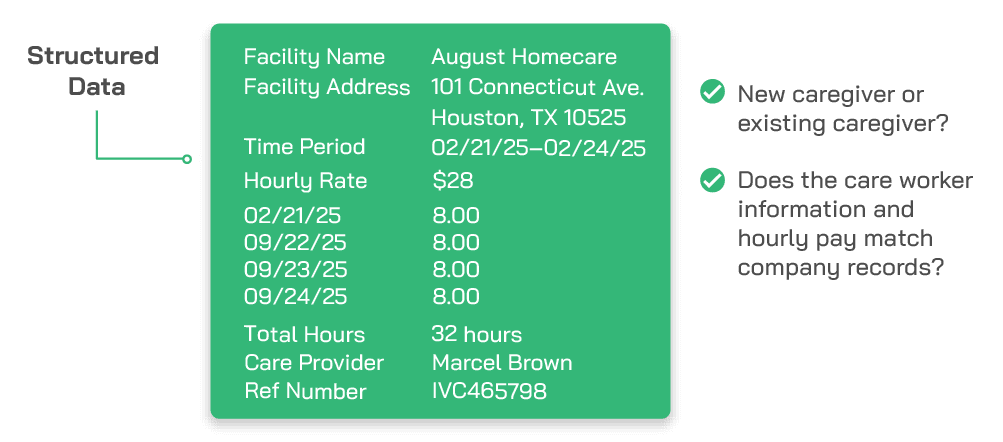

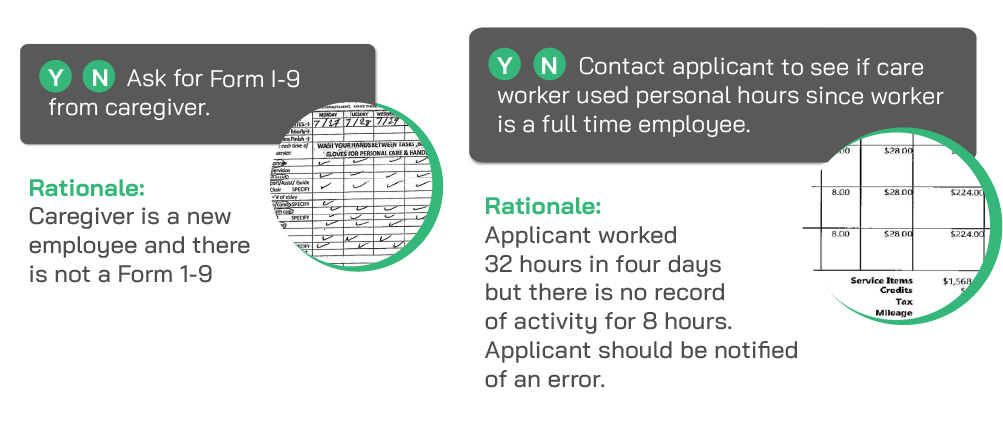

Fisent BizAI automates the ingestion, review, and processing of all caregiver invoices.

Using its Applied GenAI Process Automation framework, BizAI is able to apply the client’s reimbursement policies to all forms of billing templates to match and process the invoices while validating compliance standards — ensuring fast, accurate, and fully governed processing with zero data retention.

Accelerates TRID- compliant LE delivery

Standardizes content across disparate contract formats

Eliminates manual “stare & compare” effort

Reduces revenue leakage and tolerance cures

Deploys safely alongside existing workflows