Insurance — Specialty

Property & Casualty

AEGIS London, a leading UK insurer with over $1B in annual premium volume.

Policy Endorsement Processing

(mid-term policy changes)

AEGIS London’s underwriters were inundated with tens of thousands of endorsement requests each year—policy amendments arriving in unstructured formats from brokers and agents.

Processing each endorsement manually required interpretation, categorization, and data entry across multiple systems — averaging 5 minutes per endorsement consuming significant underwriting time and slowing service levels.

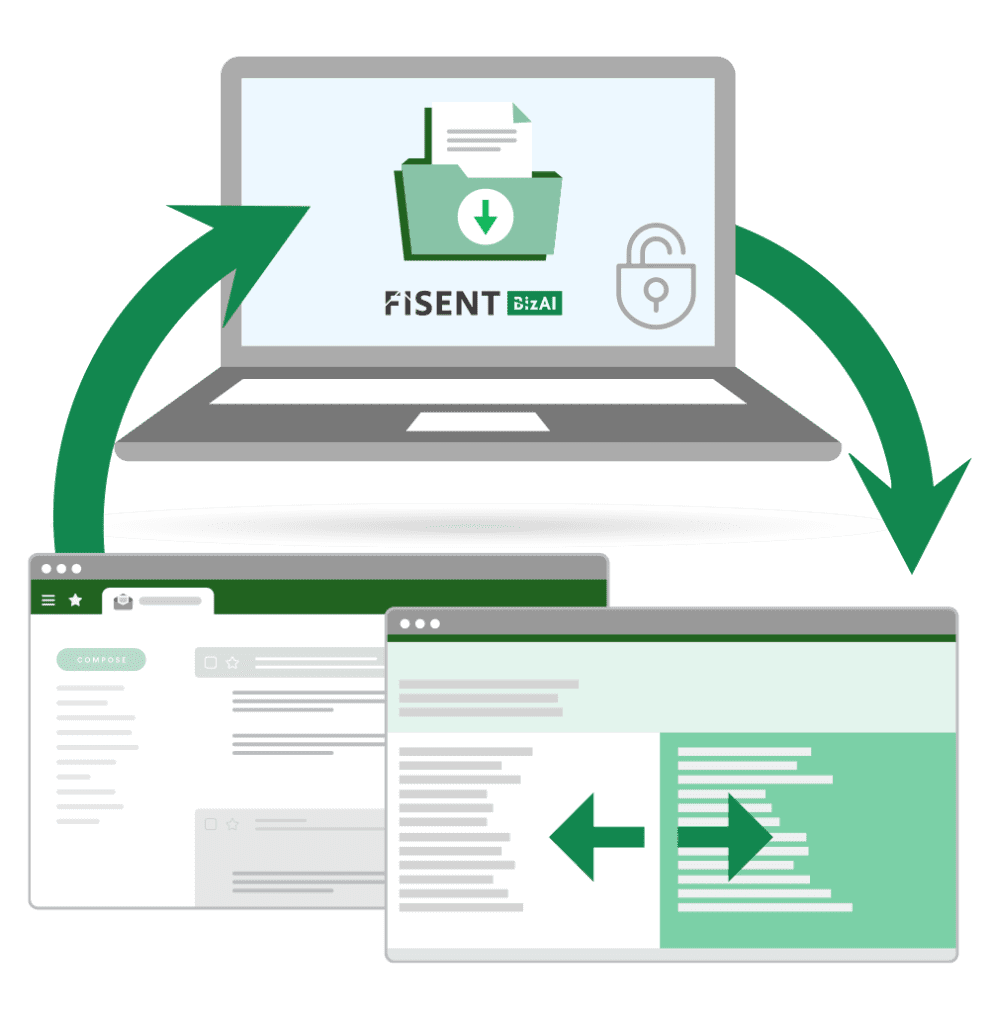

AEGIS sought a GenAI solution capable of automating the endorsement lifecycle — from understanding policy context to routing and system updates — while operating under strict governance requirements and integrating with its Pega-based platform.

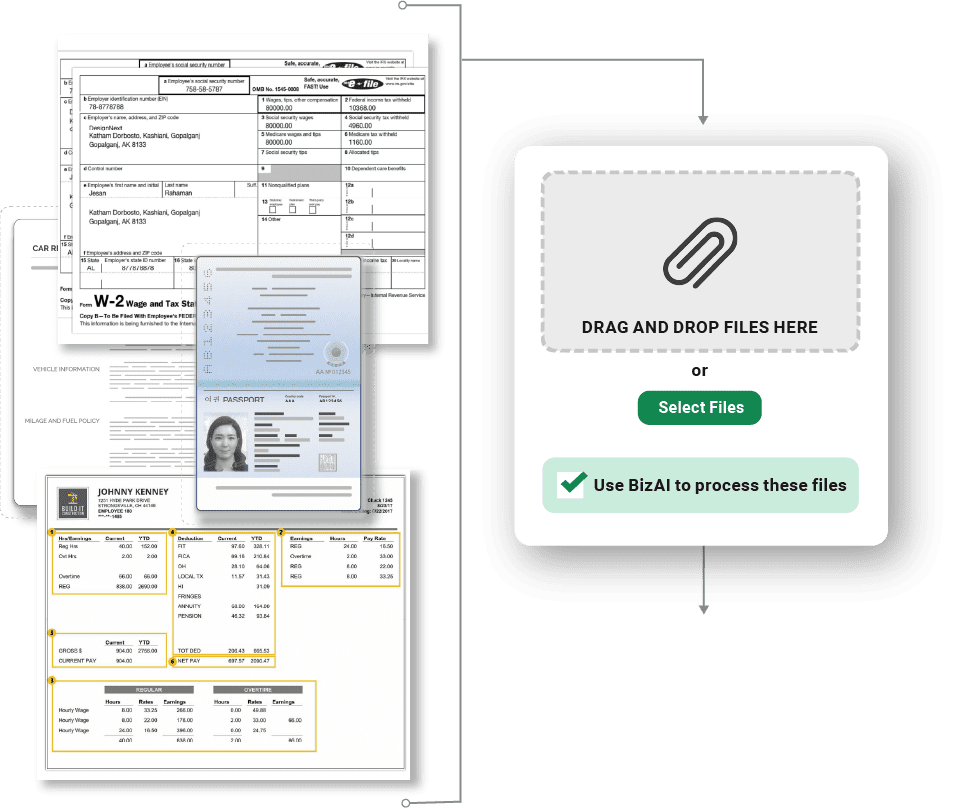

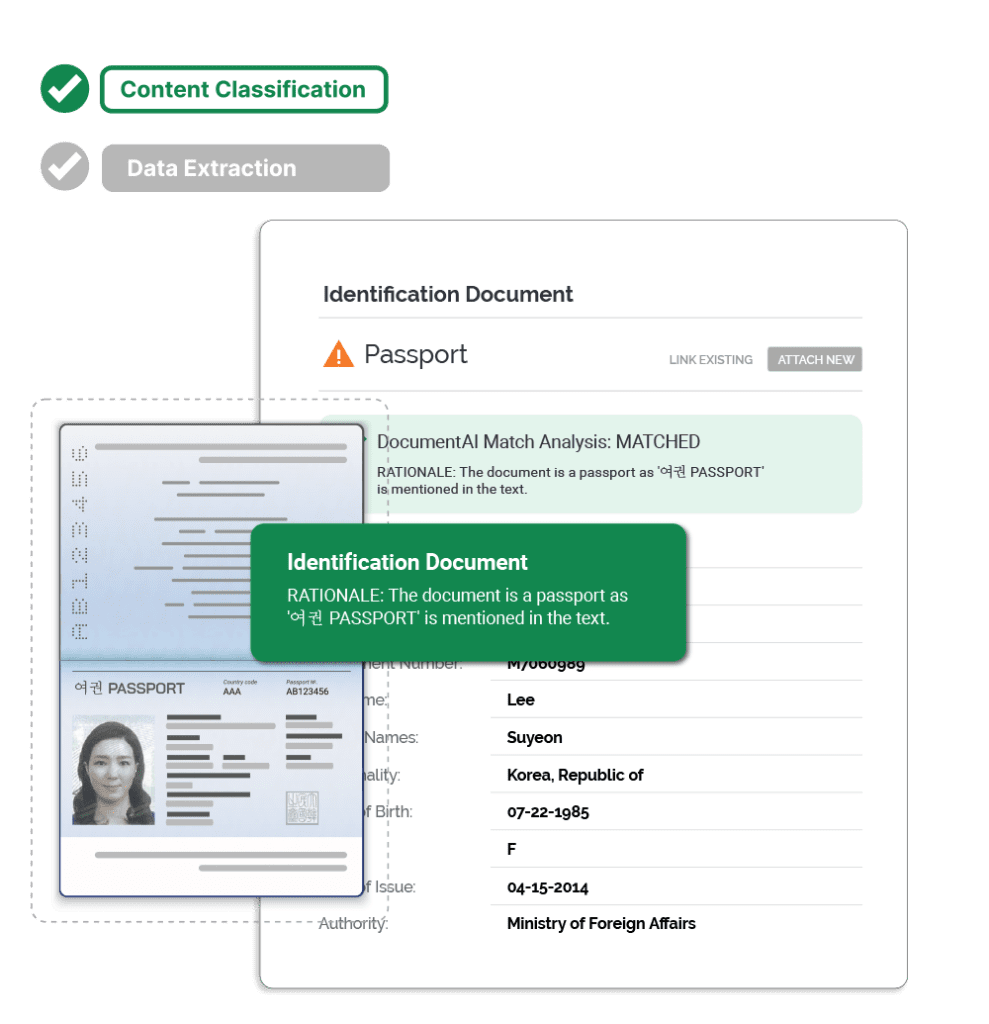

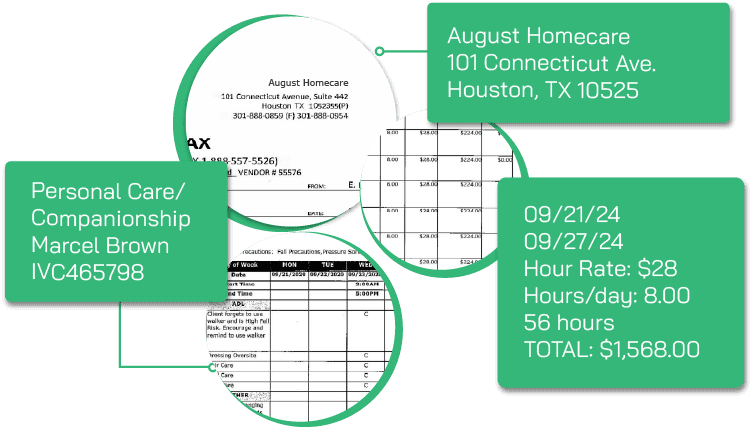

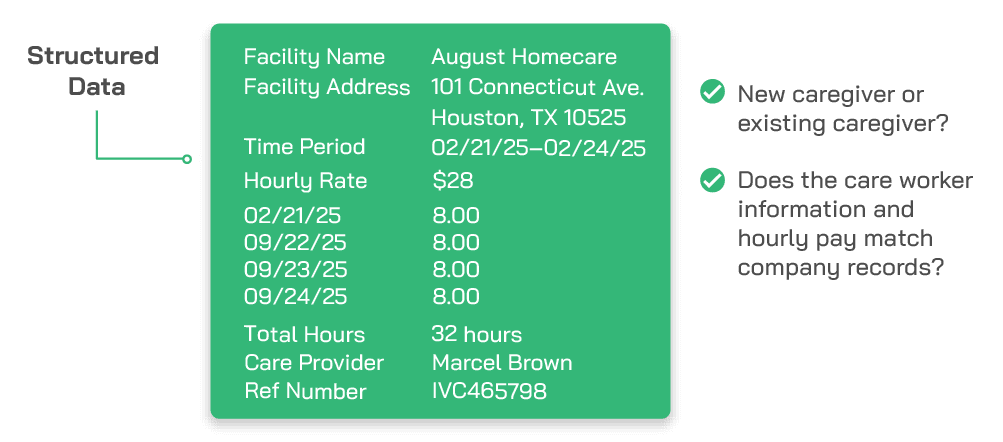

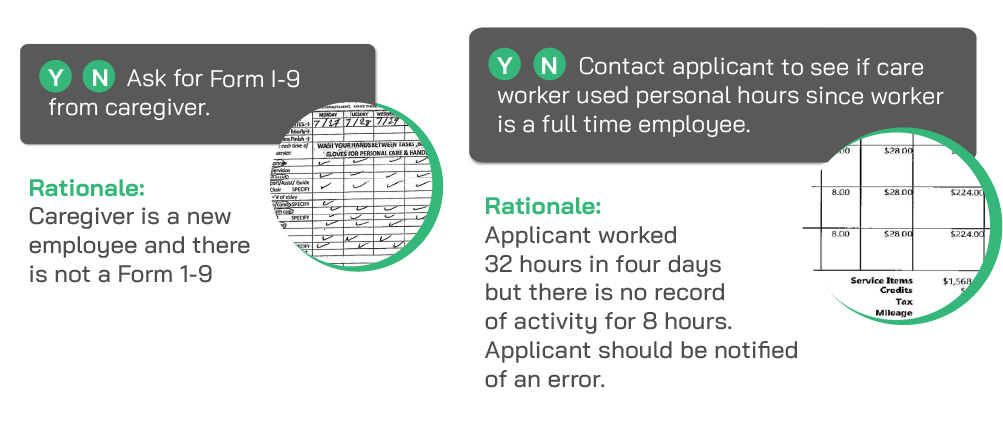

Fisent deployed BizAI, its Applied GenAI Process Automation platform, to automate endorsement processing through document understanding, rule-based inference, and contextual categorization.

Implementation details:

The system now:

Structured outputs flow to AP, claims management, and compliance systems for payment decisioning.

Non-compliant, duplicate, or unsupported invoices are routed directly to the compliance team with highlighted discrepancies.

BizAI is able to apply internal audit standards and payer compliance rules, ensuring policy and program adherence.

Every extracted field and compliance decision is fully traceable back to the source invoice and governing policy clause.