Residential Mortgage Lending

Mid-sized, privately held mortgage lender based in the U.S., offering retail, wholesale, and correspondent home loan services across all states.

Post-Closing & Accounting

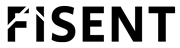

Mortgage lenders must process hundreds of Purchase Advice (PA) documents each week from multiple investors, each with its own format, structure, and naming conventions.

These PAs confirm secondary market transactions, outlining the terms, wire details, and purchase adjustments.

Historically, post-closing teams manually keyed critical fields—such as Investor Loan Number, Purchase Date, and First Payment Due Date—into loan systems, creating bottlenecks, error risks, and reconciliation delays between the lender’s core system(s) and investor reporting.

Key challenges included:

BizAI adapts to each institution’s workflow and data policies — returning structured data for system ingestion without storing, training, or retaining any client content.

80%+ automation of post-closing Purchase Advice data extraction

>95% field-level accuracy across high-variance investor templates

Reduction in manual entry and review time by over 60%

Accelerated reconciliation and accounting updates through structured data delivery

Improved standardization across investor templates, creating consistent downstream data quality

By introducing automation at this key stage of the secondary market workflow, BizAI standardizes an otherwise fragmented process — creating a unified, reliable data model for all Purchase Advices regardless of format or investor. This standardization not only improves operational speed and accuracy but also strengthens audit trails, investor relations, and regulatory reporting.