Industry: Finance Region: World Wide Client: AEGIS London

reduction in processing time

accuracy rate

Across enterprises, manual, human-dependent tasks continue to cause major inefficiencies. For information-reliant organizations like AEGIS London, data variability makes manual processes both time-consuming and prone to error.

The company’s policy endorsement process—which handles mid-year policy changes—was a critical bottleneck. Each endorsement required brokers and underwriters to interpret complex information, calculate premium adjustments, and manually update downstream systems.

With tens of thousands of annual inquiries arriving in inconsistent formats, the process was labor-intensive, averaging five minutes per endorsement and straining resources. AEGIS London recognized that Generative AI could automate much of this work but needed a partner capable of integrating seamlessly with its Pega platform and operating within a regulated environment.

The deployment evolved from an initial six rules to 55, refined through rapid feedback loops with the administrative team—continually improving accuracy and performance.

Following a detailed vendor evaluation and RFP process, AEGIS London selected Fisent as its AI partner. While other vendors focused narrowly on the London market, Fisent stood out for its agility, deep expertise, and ability to address complex enterprise-scale challenges.

The collaboration began with an accelerator sprint, a hands-on workshop involving underwriters, developers, and analysts to quickly prove the concept. AEGIS London chose the policy adjustment endorsement process as the first at-scale workflow to automate.

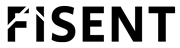

Within just six weeks, Fisent BizAI was configured to:

The deployment evolved from an initial six rules to 55, refined through rapid feedback loops with the administrative team—continually improving accuracy and performance.

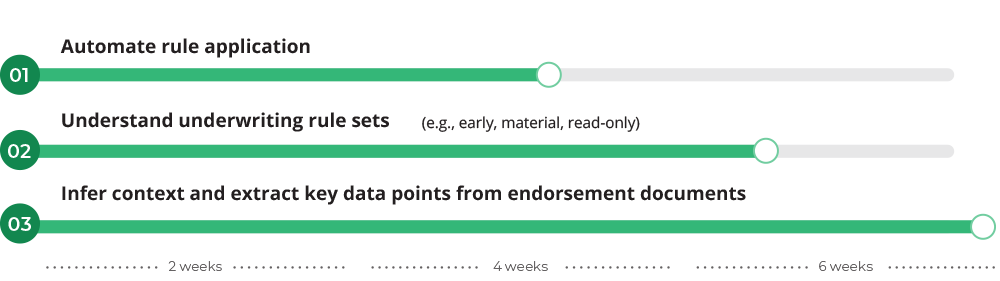

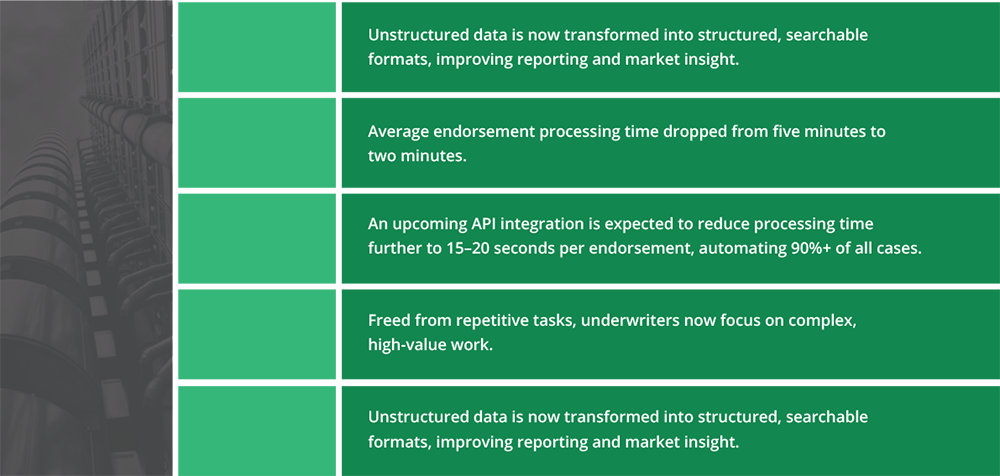

The results of implementing Fisent BizAI were immediate and transformative:

A surprising discovery emerged early in the implementation: a quarter of all endorsements were sitting unprocessed in underwriter mailboxes. This lack of visibility created a major compliance and business continuity risk.

Fisent BizAI’s automation surfaced and routed these unprocessed documents, reducing exposure and enhancing transparency. With rationalized AI-driven analysis, AEGIS London gained new insight into its risk posture, establishing a stronger, data-driven foundation for decision-making.

Following the success of endorsement automation, AEGIS London began expanding BizAI to additional use cases—such as:

Document ingestion for new insurance quotes

Creation of risk summaries

Document ingestion for new insurance quotes

AEGIS London now plans to implement three to four new business processes per year using BizAI, establishing a long- term partnership with Fisent to continuously drive operational efficiency and innovation.

Discover how BizAI can quickly be up and running in days or weeks, not months, with no downtime. Call or email for a free custom demo with your use case and see for yourself.