Insurance — Specialty

Property & Casualty

AEGIS London, a leading UK insurer with over $1B in annual premium volume.

Policy Endorsement Processing

(mid-term policy changes)

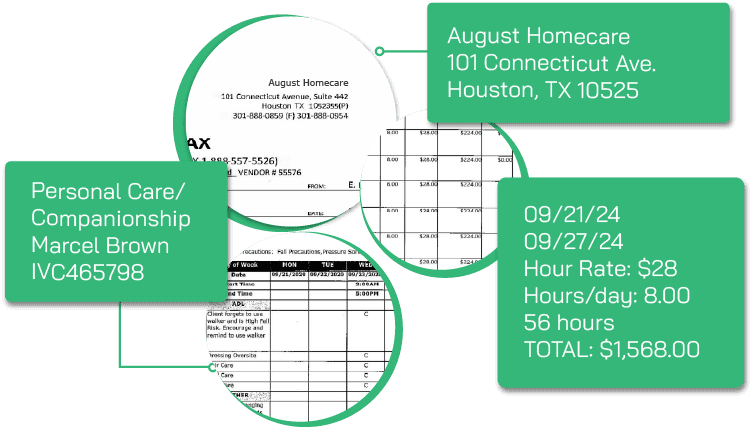

AEGIS London’s underwriters were inundated with tens of thousands of endorsement requests each year—policy amendments arriving in unstructured formats from brokers and agents.

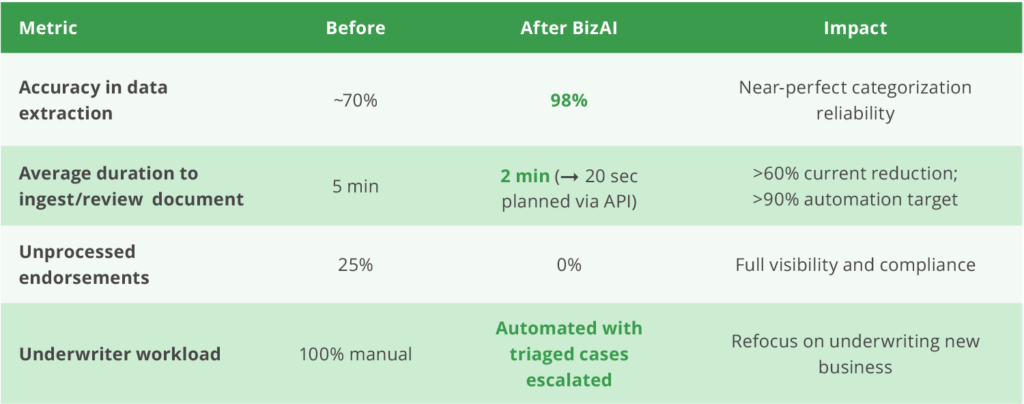

Processing each endorsement manually required interpretation, categorization, and data entry across multiple systems — averaging 5 minutes per endorsement consuming significant underwriting time and slowing service levels.

AEGIS sought a GenAI solution capable of automating the endorsement lifecycle — from understanding policy context to routing and system updates — while operating under strict governance requirements and integrating with its Pega-based platform.

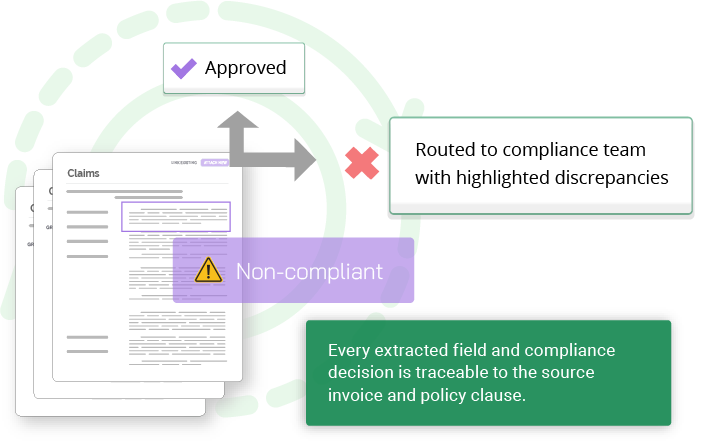

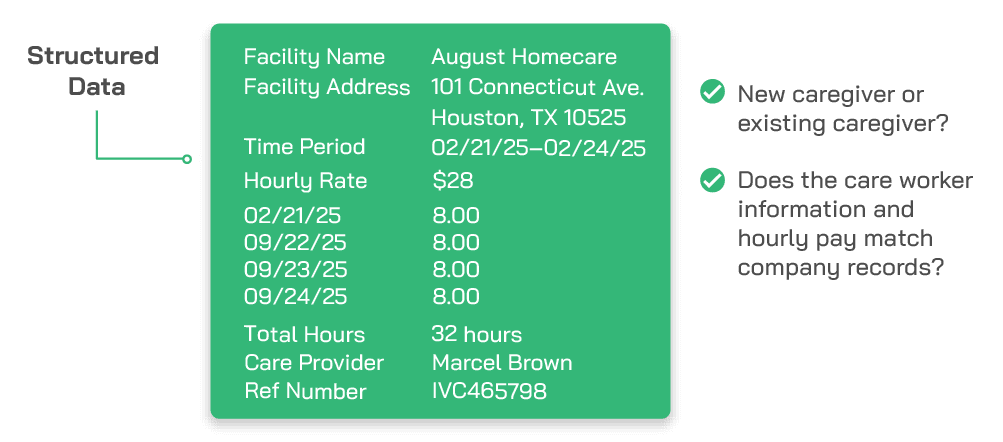

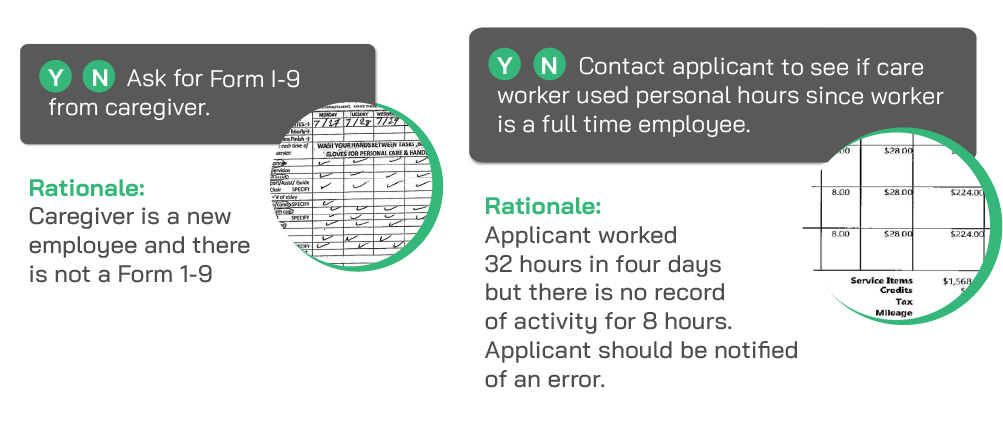

Fisent deployed BizAI, its Applied GenAI Process Automation platform, to automate endorsement processing through document understanding, rule-based inference, and contextual categorization.

Implementation details:

Agentic Actions Framework

End-to-end automation of endorsement classification, review, and processing.

High ROI within months of deployment, enabling a roadmap for 8-10 new automation use cases per year.

Scalable deployment across other document-heavy processes (e.g., request for quote ingestion, risk summaries).

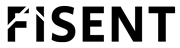

Non-compliant, duplicate, or unsupported invoices are routed directly to the compliance team with highlighted discrepancies.

AEGIS London’s deployment of Fisent BizAI demonstrates the measurable impact of Applied GenAI Process Automation in insurance operations.

AEGIS London’s deployment of Fisent BizAI demonstrates the measurable impact of Applied GenAI Process Automation in insurance operations.

By transforming endorsement processing from a manual, error-prone task into a high-accuracy, low-latency digital workflow, AEGIS achieved new levels of efficiency, transparency, and risk control—laying the foundation for its broader automation strategy.