Financial Services/Banking

Customer Support/Operations

Customer Complaints Management, Intake & Triage, Regulatory Response

Customer complaints arrive through multiple unstructured channels including email, scanned letters, handwritten notes, branch-captured documents, and mailed correspondence. Each complaint must be manually opened, read, interpreted, categorized, and routed to the correct internal function (e.g., fraud, deposits, prepaid, ACH, card operations, disputes).

Customer complaints arrive through multiple unstructured channels including email, scanned letters, handwritten notes, branch-captured documents, and mailed correspondence. Each complaint must be manually opened, read, interpreted, categorized, and routed to the correct internal function (e.g., fraud, deposits, prepaid, ACH, card operations, disputes).

Manual review is time-consuming, inconsistent, and creates operational risk—particularly when complaints include complex identifiers such as account numbers, dates, SSN references, program names, intake notes, or third-party details. This slows downstream investigations, affects regulatory response times, and increases the risk of misrouted complaints, incomplete documentation, or untimely resolution.

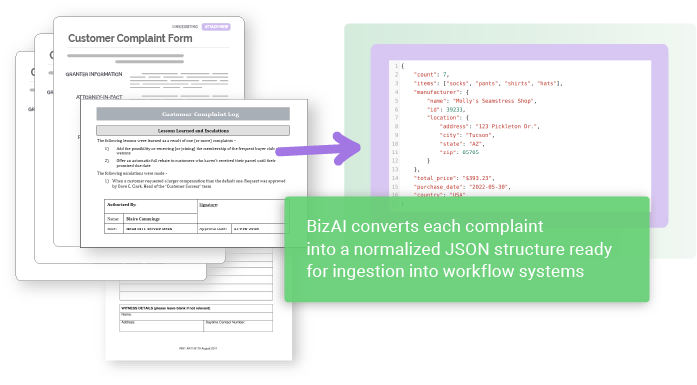

BizAI automates end-to-end intake by reading and structuring information from complaints across any format, including typed letters, scanned PDFs, photographed documents, and handwritten text.

Using a field-extraction schema defined by the customer, BizAI identifies and normalizes key complaint data elements such as:

(e.g., Onspring, ServiceNow, internal case management workflows, etc.).

BizAI then classifies the complaint category and routes it to the appropriate operations team for investigation & ultimately resolution.

(filtered to the Bank when required)

(secondary identifiers, DOB/SSN references, case no,, related parties)

Cuts manual intake and classification from minutes per complaint to seconds

Ensures complaints reach the correct business function correctly the first time

Eliminates dependence on clean, structured digital formats

Strengthens documentation quality and completeness for audits and complaint-response timelines with structured data outputs

Allows the bank to process large influxes of complaints without increasing staff

Produces clean, structured complaint records for downstream analytics and reporting