Wealth Management / Financial Services

A leading North American Wealth Management firm

Account maintenance — POA validation, analysis, and data extraction for compliance and operations

Processing Power of Attorney (POA) documents is one of the most complex and error-prone administrative tasks in wealth management. These documents differ across jurisdictions, contain dense legal language, and require multiple layers of verification to ensure compliance and fiduciary integrity.

Processing Power of Attorney (POA) documents is one of the most complex and error-prone administrative tasks in wealth management. These documents differ across jurisdictions, contain dense legal language, and require multiple layers of verification to ensure compliance and fiduciary integrity.

Additional challenges included:

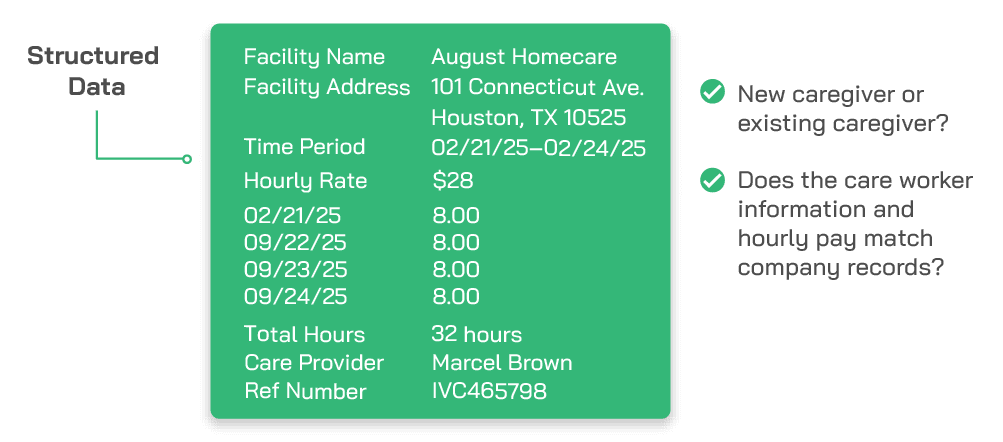

Fisent BizAI, an Applied GenAI Process Automation solution, was deployed to automate the end-to-end POA validation and data extraction workflow.

Improved Compliance: Automatic validation against state-specific requirements significantly reduces regulatory and fiduciary risk.

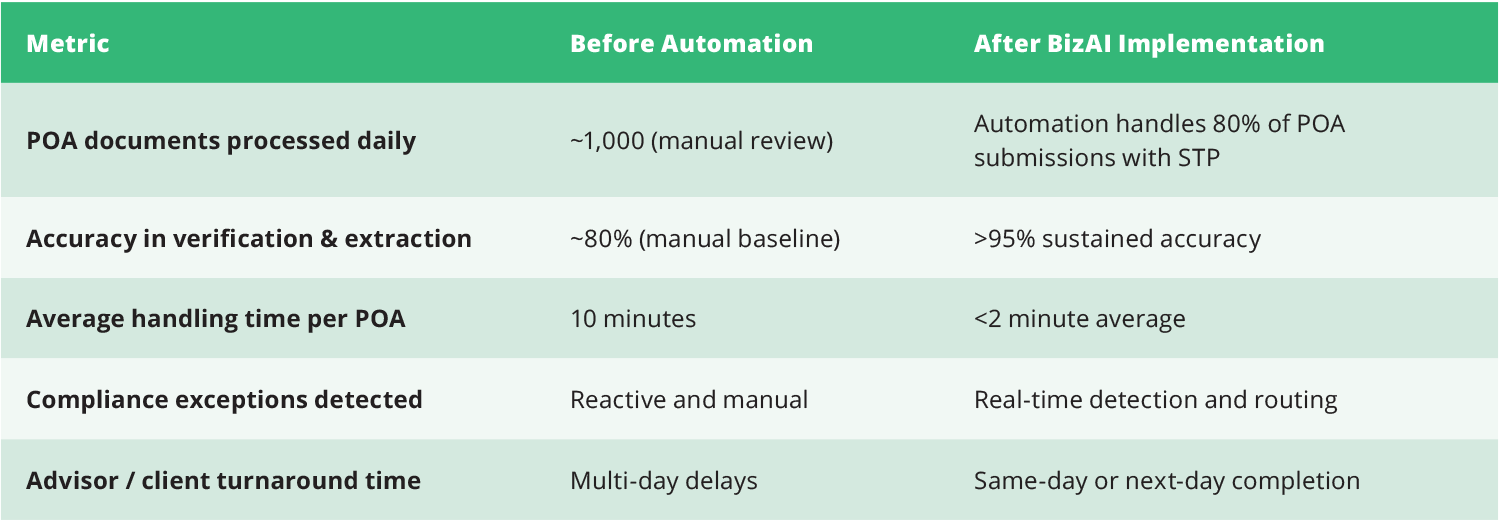

Operational Efficiency: POA review time reduced by over 80%, freeing staff for higher-value client and advisory work.

Data Reliability: Structured, validated output improves the accuracy of downstream account management systems.

Scalability: BizAI’s adaptable model handles continuous volume growth without additional headcount.

Transparency: Every automated decision is logged and explainable, ensuring audit readiness.

By deploying Fisent BizAI, this leading wealth management firm transformed a high-risk, labor-intensive compliance process into an automated, auditable workflow.

BizAI’s Applied GenAI capabilities not only achieved over 95% accuracy in POA validation and data extraction but also created a scalable foundation for automating other document-driven processes such as account opening, trust documentation, and beneficiary updates.