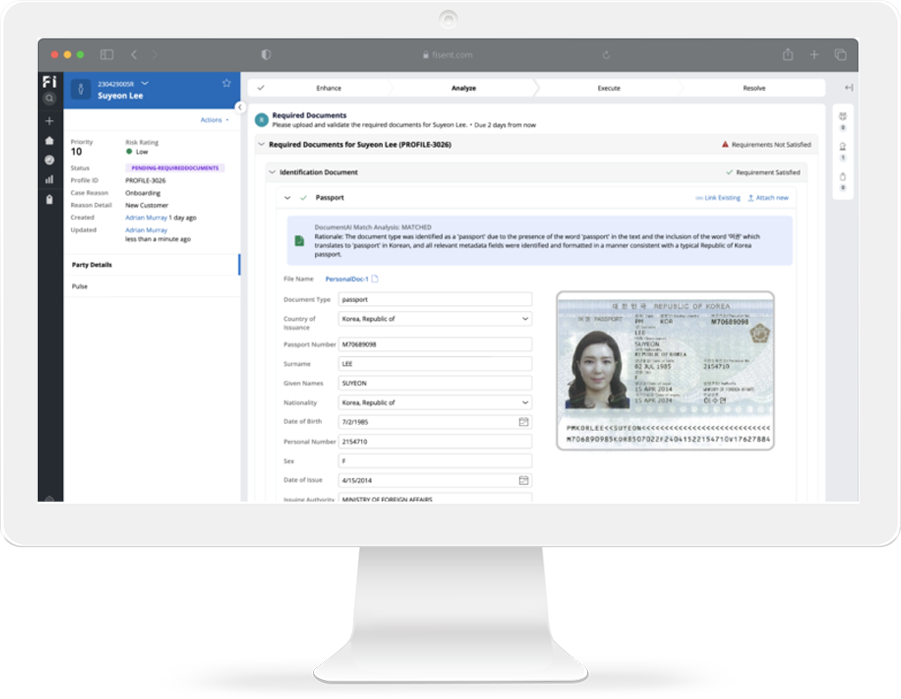

Fisent Risk is an advanced risk engine and risk management platform that allows institutions to calculate, manage and maintain quantitative customer risk scores, as well as automate the associated risk assessment lifecycle.

By using the Fisent Risk platform, institutions can automate a substantial number of their initial and periodic customer risk reviews. In addition, the institution can leverage complex risk models through a simple, user friendly interface, which can be managed directly by end users.

Current solutions for managing risk are out of date, lack scalability, auditability and the complexity necessary to meet modern regulatory requirements and industry demands.

A risk engine can enable institutions to take their manual, fragmented risk assessment processes and move them into a defined, objective, auditable framework. A risk platform can help institutions to streamline and organize the process of calculating risk, as well as the ongoing management of that risk.

Save by eliminate excel and paper based processing

Provide a single interface for audit risk review

Enforce business processes, SLAs and intelligent work routing

Use our platform to drive and enhance decisioning

When the application is deployed we provided complete support and maintenance for all issues via a dedicated service desk.

Fisent offers a variety of solutions for deployment, including shared cloud, dedicated cloud and even support for on premise hosting.

The risk model is heavily customizable depending on the specific policies and tolerances of the institution. In fact it was designed this way deliberately.

Customers can interact with Fisent Risk both as a platform, as well as by leveraging REST APIs for more complex or targeted integrations.

Fisent Risk can be implemented significantly faster than a traditional Pega application. The solution has been designed to deliver standard capabilities with minimal configuration.

Fisent risk is taking advantage of the latest AI technology by developing connectors to important services like OpenAI to integrate the latest GPT models. There are already a number of natural use cases developed using GPT, including documentAI and riskAI, solutions that are transforming the way organizations can manage unstructured work.